The Art of Calculating Overtime in Colorado

If your business operates in Colorado, understanding state-specific overtime rules is just as critical as knowing federal laws. While the Fair Labor Standards Act (FLSA) requires overtime pay for nonexempt employees working over 40 hours in a workweek, Colorado’s Overtime & Minimum Pay Standards (COMPS) Order adds additional regulations that employers must follow.

On the surface, calculating overtime appears to be straight forward, even if math isn’t your strong suit. Calculating overtime when you pay your employees on a semi-monthly pay schedule, however, introduces a far more complex calculation than other pay schedules. Let’s break it down.

Semi-Monthly Pay Period

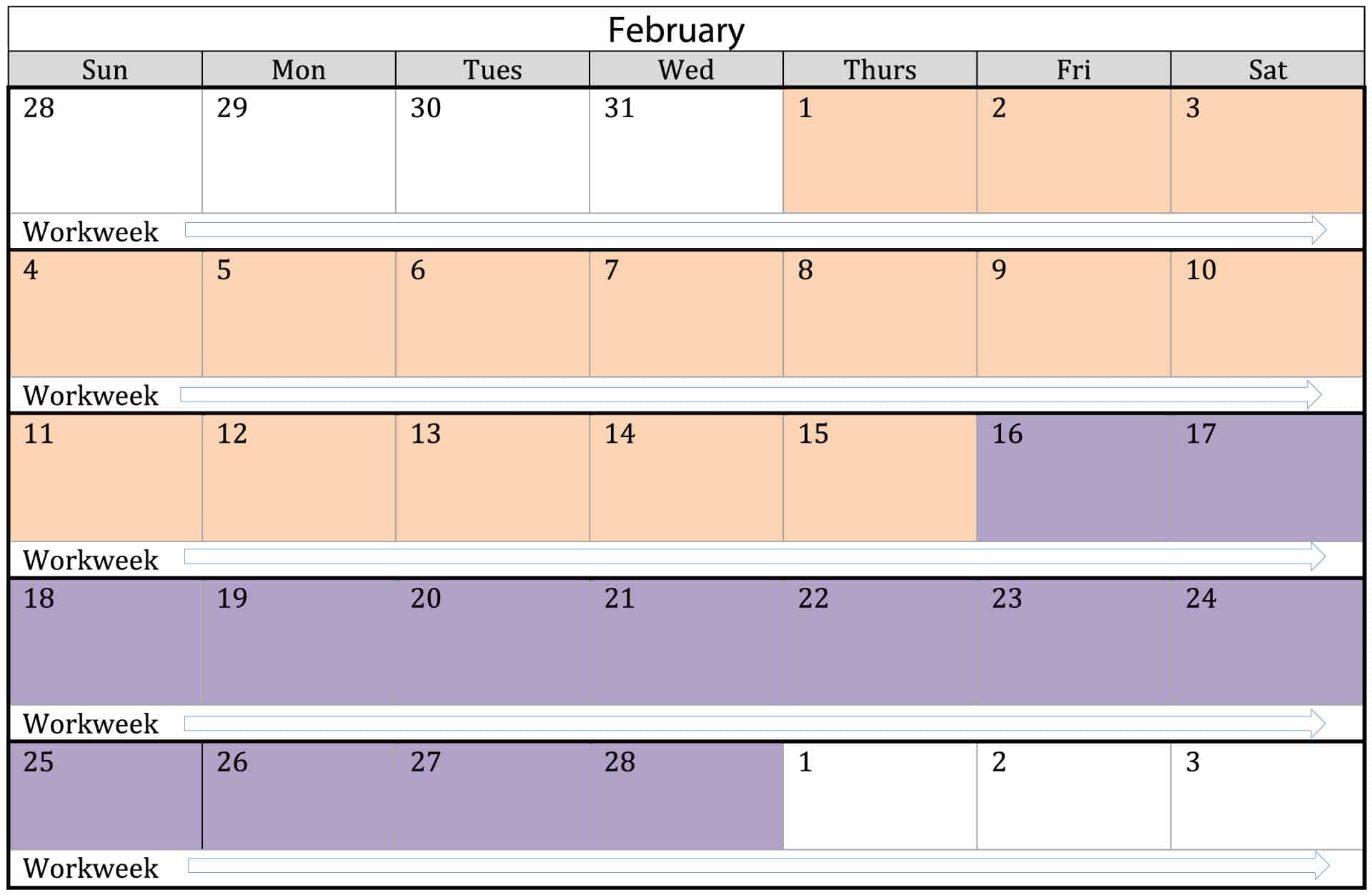

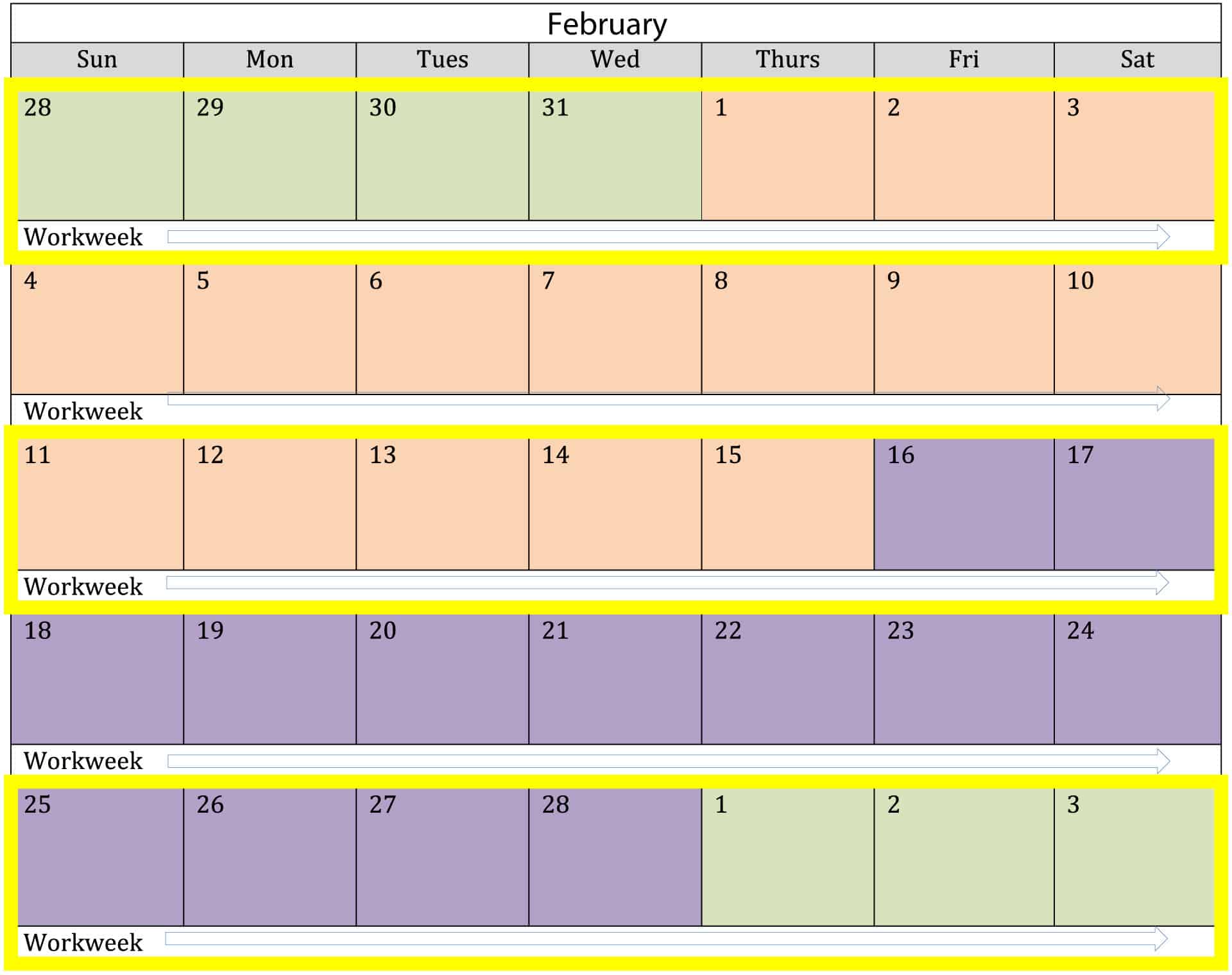

Having a semi-monthly pay period will create two pay days per month and there are several different options when creating a semi-monthly pay period. For the sake of simplicity, we have chosen the pay periods of the 1st15th and the 16th-last day of the month for our examples below. The pay periods are identified in orange and purple.

As opposed to a bi-weekly pay period, a semi-monthly pay schedule means that pay days may land on different days of the week. Likewise, a pay period may span across more than one workweek, which is where the confusing calculation of overtime comes into play. An employer is required to look at the workweek and not the pay period when calculating overtime. This means that you may have to look at the hours worked from days in a previous pay period to calculate a workweek’s hours. Highlighted in yellow outlines below are examples of where two pay periods share a workweek.

Calculating Overtime

| Company: | ElectroCity |

| Employee: | Jack Black |

| Rate of Pay: | $15.00 / hour |

| Pay Schedule: | Semi-Monthly |

| Pay Period: | February 1st – 15th |

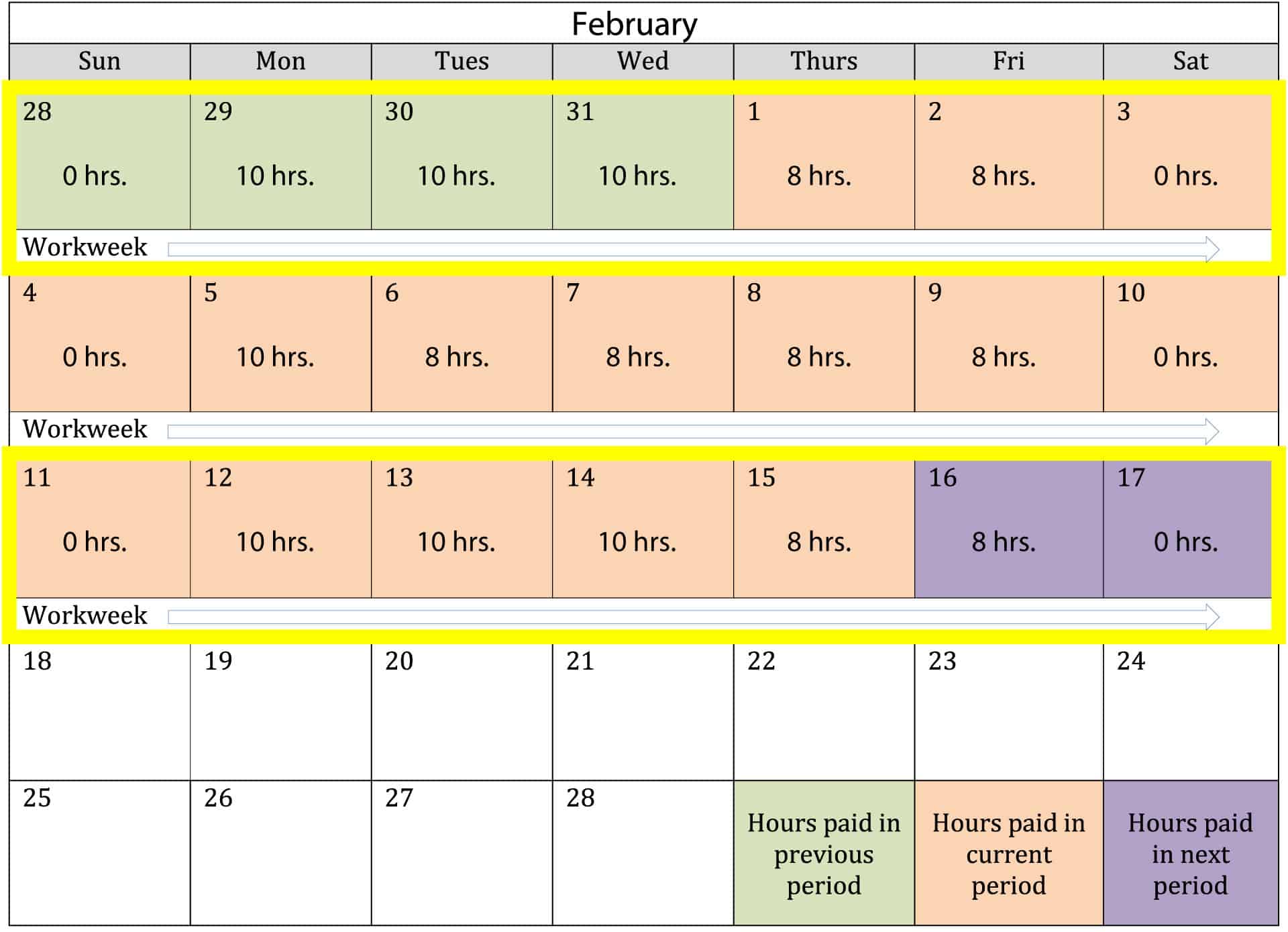

Below is an example of how an employer would calculate overtime hours in a semi-monthly pay period.

| Workweek 1 | |

|---|---|

| Total hours in workweek | 46 |

| Total overtime hours | 6 |

| Total hours for pay period | 10 Regular + 6 OT |

In Workweek 1 we can see that Jack Black worked a total 46 hours, 6 of which are overtime. Only 10 regular hours and 6 overtime hours will be paid for the pay period because 30 hours were already paid in the previous pay period.

| Workweek 2 | |

|---|---|

| Total hours in workweek | 42 |

| Total overtime hours | 2 |

| Total hours for pay period | 40 Regular + 2 OT |

Workweek 2 is entirely within the pay period, with no days falling into other pay periods. The entire total of 40 regular and 2 overtime will be paid for the pay period.

| Workweek 3 | |

|---|---|

| Total hours in workweek | 46 |

| Total overtime hours | 6 |

| Total hours for pay period | 38 Regular |

Workweek 3 includes days for the upcoming pay period. The overtime hours for Workweek 3 fall within that pay period and not the current pay period. Therefore, only 38 regular hours will need to be paid – any overtime hours for the workweek will be paid in the next pay period.

| Gross Payment Calculation | Rate | Gross Total | |

|---|---|---|---|

| Total Regular Hours | 88 | $15 | $1,320.00 |

| Total Overtime Hours | 8 | ($15 x 1.5) | $180.00 |

| Total Payment | $1,500.00 | ||